- Revolutionizing Real Estate: The Rise of Tokenization Platforms

- How Tokenization is Transforming Real Estate Investment Strategies

- A Deep Dive into the Top Tokenization Platforms for Property Assets

- Navigating the Benefits and Challenges of Real Estate Tokenization

- The Future of Real Estate Transactions: Understanding Tokenization Technology

- Case Studies: Successful Implementations of Tokenization in Real Estate

Revolutionizing Real Estate: The Rise of Tokenization Platforms

The real estate industry is undergoing a significant transformation, largely driven by the emergence of tokenization platforms. These innovative systems are reshaping the way properties are bought, sold, and managed. Tokenization platforms allow for the fractional ownership of real estate assets, enabling investors to purchase shares in properties rather than entire buildings. This democratization of access is opening up the real estate market to a broader audience, making investment opportunities more accessible.

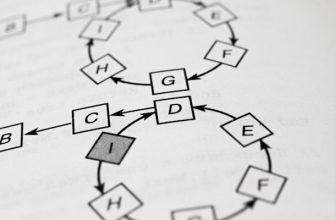

Tokenization platforms leverage blockchain technology, ensuring transparency and security in transactions. Each real estate asset is represented as a digital token, which can be traded on various exchanges. This process not only streamlines transactions but also reduces the complexities and costs typically associated with traditional real estate investments.

- Enhanced Liquidity: Tokenization platforms provide increased liquidity for real estate investments, allowing investors to buy and sell tokens easily.

- Lower Barriers to Entry: With fractional ownership, investors can enter the market with smaller amounts of capital, making real estate investment more attainable.

- Global Access: Tokenization eliminates geographical barriers, allowing investors from around the world to participate in real estate markets that were previously inaccessible.

- Smart Contracts: Automated agreements reduce the need for intermediaries, speeding up transactions and enhancing security.

As the popularity of tokenization platforms continues to rise, various companies are leading the charge in this innovative space. These platforms are not only changing how real estate is perceived but are also setting new standards for investment and ownership. The future of real estate is undeniably linked to the advancements in tokenization technology, promising a more efficient and inclusive market for all participants.

How Tokenization is Transforming Real Estate Investment Strategies

Tokenization is revolutionizing the landscape of real estate investments by introducing innovative strategies that enhance accessibility and liquidity. By converting physical assets into digital tokens on a blockchain, investors can now partake in real estate opportunities that were once reserved for affluent individuals or institutional players.

This transformative approach enables fractional ownership, allowing multiple investors to own a portion of a property. Such a model not only democratizes access to real estate investment but also minimizes the financial barriers typically associated with property purchases. As a result, tokenization platforms are paving the way for a broader range of investors to engage in lucrative markets.

- Enhanced Liquidity: Traditional real estate investments can take years to sell. Tokenized assets can be traded on various platforms, providing quicker access to funds.

- Lower Investment Thresholds: Investors can buy fractional shares of high-value properties, making it easier for individuals to diversify their portfolios.

- Global Access: Tokenization platforms enable investors from different geographical locations to invest in real estate markets worldwide, broadening investment horizons.

- Transparency and Security: Blockchain technology ensures that all transactions are recorded immutably, providing a high level of security and transparency for investors.

Moreover, the rise of tokenization platforms is fostering a new era of compliance and regulatory oversight. Smart contracts, a key feature of many tokenization solutions, help ensure that all transactions adhere to relevant regulations, thus instilling greater confidence among investors.

As the real estate sector continues to embrace these cutting-edge tokenization strategies, the potential for innovation and growth in investment approaches is vast. This shift not only enhances the efficiency of real estate transactions but also opens up numerous avenues for investors seeking to maximize their returns in an increasingly competitive market.

A Deep Dive into the Top Tokenization Platforms for Property Assets

The landscape of property assets is undergoing a significant transformation through the advent of tokenization platforms. These innovative systems allow for the fractional ownership of real estate, transforming how investments are made and managed. Tokenization platforms for property assets leverage blockchain technology to create digital tokens that represent ownership shares in real estate properties, making it easier for investors to participate in the market.

Among the various options available, several top tokenization platforms stand out for their unique features and capabilities. These platforms not only enhance liquidity in real estate investments but also offer transparency and security, which are critical in today’s market. Below are some of the leading tokenization platforms for property assets:

- Real Estate Tokenization Platform A: Known for its user-friendly interface and robust security measures, this platform enables seamless transactions and offers a wide range of property assets for tokenization.

- Real Estate Tokenization Platform B: This platform specializes in commercial properties and provides investors with access to high-value real estate assets through tokenization, ensuring high liquidity and attractive returns.

- Real Estate Tokenization Platform C: Focused on residential properties, this platform allows individual investors to own fractions of homes, promoting accessibility in the real estate market.

- Real Estate Tokenization Platform D: A leader in regulatory compliance, this platform ensures that all tokenized transactions adhere to legal standards, providing peace of mind for investors.

Each of these tokenization platforms for property assets offers unique advantages, catering to different types of investors and property types. As the demand for innovative investment solutions grows, the role of tokenization in real estate will likely expand, paving the way for a more inclusive and efficient market.

Investing in tokenized real estate assets not only opens up new avenues for capital but also democratizes access to real estate ownership. The continued evolution of tokenization platforms is set to reshape the future of property investments, making them more accessible, efficient, and profitable for a broader range of investors.

Navigating the Benefits and Challenges of Real Estate Tokenization

Real estate tokenization represents a transformative approach to property investment, merging traditional real estate with blockchain technology. This innovative method allows for fractional ownership, enabling investors to buy and sell tokens that represent shares in real estate assets. While the benefits of this modern investment method are compelling, certain challenges must also be addressed to ensure a smooth transition into this evolving landscape.

- Enhanced Liquidity: Tokenization allows for quicker transactions compared to traditional real estate sales, facilitating a more liquid market.

- Lower Barriers to Entry: By enabling fractional ownership, tokenization democratizes access to real estate investments, allowing smaller investors to participate.

- Transparency: Blockchain technology provides an immutable record of transactions, enhancing trust and accountability in the real estate market.

- Global Reach: Tokenized real estate can attract international investors, broadening the potential buyer pool and increasing market opportunities.

- Cost Efficiency: Automating processes through smart contracts can reduce transaction costs and streamline operations in real estate management.

Despite these advantages, navigating the challenges of real estate tokenization is crucial for its success. Regulatory uncertainties present significant hurdles, as the legal status of tokens varies across jurisdictions. Additionally, the technological complexities involved in implementing blockchain solutions can pose risks for both developers and investors. Security concerns, such as the potential for hacks and data breaches, also remain prevalent in discussions surrounding this innovative investment method.

Ultimately, the journey of real estate tokenization is one marked by both promise and caution. Stakeholders must remain informed about the evolving regulatory landscape and technological advancements to fully harness the potential of tokenization while mitigating associated risks. Embracing this cutting-edge approach to property investment may redefine how assets are owned and traded, paving the way for a more inclusive and efficient real estate market.

The Future of Real Estate Transactions: Understanding Tokenization Technology

The evolution of real estate transactions is significantly influenced by innovative technologies, particularly tokenization. Tokenization technology is transforming how properties are bought, sold, and managed, offering enhanced transparency and efficiency in real estate dealings.

By converting real estate assets into digital tokens on a blockchain, this technology enables fractional ownership and broader access to investments. This approach democratizes real estate investment opportunities, allowing individuals to invest in high-value properties with lower capital requirements.

- Transparency: Tokenization ensures that every transaction is recorded on a public ledger, enhancing trust among participants.

- Liquidity: Real estate tokens can be traded on various platforms, increasing market liquidity.

- Reduced Costs: The elimination of intermediaries in transactions can lead to lower fees and faster processing times.

- Global Reach: Tokenized properties can attract international investors, expanding the market significantly.

- Smart Contracts: Automated agreements streamline transactions and reduce the potential for disputes.

As the real estate market embraces tokenization, several platforms are emerging, each offering unique features and benefits. These platforms are designed to cater to different types of investors, from those looking for passive income to active real estate enthusiasts seeking diverse portfolios.

In summary, tokenization technology is reshaping the future of real estate transactions. By enhancing liquidity, transparency, and accessibility, it opens up new avenues for investment and participation in the real estate market. The ongoing development of tokenization platforms promises to further revolutionize the landscape of property transactions, making it essential for stakeholders to stay informed about these advancements.

Case Studies: Successful Implementations of Tokenization in Real Estate

The integration of tokenization in real estate has led to significant advancements in property investment and ownership. Numerous successful implementations exemplify how cutting-edge tokenization platforms are transforming the industry by enhancing liquidity, accessibility, and transparency.

- Example 1: Real Estate Fund Tokenization – A prominent real estate fund utilized a tokenization platform to fractionalize ownership of high-value properties. This approach allowed investors to purchase tokens representing shares in the fund, thus democratizing access to lucrative real estate investments.

- Example 2: Residential Property Tokenization – A startup launched a residential property tokenization project, enabling buyers to invest in residential units through blockchain-based tokens. This initiative not only increased market participation but also provided a seamless transaction process for investors.

- Example 3: Commercial Real Estate Tokenization – A well-known commercial real estate firm adopted a tokenization strategy for its buildings. By tokenizing the assets, the firm facilitated easier sales and trades of property interests, attracting a wider range of investors and enhancing liquidity.

- Example 4: International Property Investment – A global real estate platform introduced tokenization to allow international investors to partake in local markets without the complexities of traditional property ownership. This innovation broadened the investor base and opened new opportunities for cross-border investment.

These case studies illustrate the transformative impact of tokenization in real estate. By leveraging cutting-edge tokenization platforms, stakeholders can optimize investment strategies and streamline property transactions, thereby driving the future of real estate investment.